There are many new and useful financial products available in the marketplace today , however many consumers are either simply not aware of how they work or for that matter even of their existence.

One such vehicle is a relatively new addition to the world of Annuities and is called an Equity Indexed Annuity.

It would be a great New Years resolution for everyone to learn about how these new products can best serve you and your Family in reaching your retirement goals and objectives while not losing any sleep.

A fixed annuity is an accumulation planning vehicle that allows an individual to accumulate money they’re not going to need for at least 5-7 years. One of the benefits of this type of vehicle is that it offers a return significantly larger than usually offered in a bank CD or money market fund. In addition it allows the money to accumulate on a tax deferred basis. In addition It is GUARANTEED by the Life Insurance company that issues the contract. Even in this day and age of Bailouts and failed financial institutions that GUARANTEE is extremely meaningful as not one investor has ever lost a nickel in a failed Life Insurance contract.

One might say its a perfect vehicle , why doesn’t everyone take advantage of it . The fact of the matter is that countless contract holders have purchased billions of dollars of these instrument. However there is one shortfall and that is that the investment does not allow an individual to participate in any growth ,other than a 3-4% fixed rate of return. Over an extended period of time this return can be ravaged by inflation.

The Insurance Industry’s answer to this problem has been the creation of a relatively new product called a “Equity Indexed Annuity” This vehicle contains all of the other previously mentioned benefits with one major exception. That exception allows a contract holder to also participate in the overall return of the stock market, most often the S&P. That return despite what were currently seeing today has historically been in the 9-10% range over most of the past 10 year periods. As with all annuities one must make certain that the money placed in this investment will not be needed prior to age 591/2 and that it will not be needed for at least the following 7 year period as there is usually a 7 year declining surrender charge that an investor would have to pay if they wanted to withdraw the money prior to the 7 year holding period. The penalty usually starts at 7% and declines to 1% over a 7 year period.

It would therefore be a very smart idea today for an individual investor to learn more about this investment that allows one to participate in the stock markets appreciation while protecting against a loss in the event of a downturn and or market volatility, similar to what we’ve experienced in the market over the last 2 years.

As always feel free to contact me with any questions or comments.

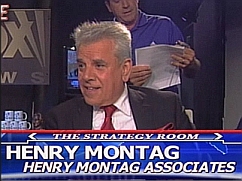

About the Author: Henry Montag is an Independent Certified Financial Planner as well as a CLTC. He’s been in practice since 1976. He is a contributing writer for The Moneypaper, a national financial publication, and sourced by Investors business Daily, Long Island Business News, Newsday, Wall St Journal, The Moneypaper, Investment News, Senior Lifestyles and has held insurance and securities licenses for over thirty years.

333 Earle Ovington Blvd

Uniondale NY 11553I

516 394-2595

web site www.FINANCIALFORUMSINC.COM

Leave a Reply