In addition to the normal day-to-day stuff you have to do on a daily basis just to keep the doors of your business open and the employees and customers happy, you as a business owner are charged with an additional set of responsibilities.

These special responsibilities are unique to yourself as well as all other successful business owners. Simply stated, how will the business you started from its infancy support you now that you’re ready to retire? Who will act as your replacement? What have you done to assure that the money will be there for your family to buy out your partner or shareholders shares in the event that anything happens to either one of you? If it’s a key person what have you done to assure that he or she will not leave to start a business of their own just when you and or your partner are ready to retire, or worse in the event of a premature death or disability?

What arrangements have you made to qualify whether your son or daughter should come into the business, take over the reins, and be able to pay you and your spouse an adequate retirement income for the work you’ve put into the business for the last 20-30 years?

Yes, you know that you have enough monies in retained earnings to be able to get you through a difficult time but what’s the best structure for that money, while it’s just sitting there? What’s the best way to maximize those dollars for you and your family? You probably also know that you should have enough life insurance to pay for you and your partners share of each of your respective ownership percentages in the business in the event that either one of you prematurely pass away, or become disabled.

You’re also aware of the fact that you could use some of those earnings to tie in a key employee with what’s known as a “Golden Handcuff” — a way to make certain that a valuable key employee won’t leave before you want him/her to leave. This can best be accomplished by providing a bonus you’ve prepaid but only if they remain in your employ as a loyal employee for a set number of years.

In order to accomplish many of these goals you should have a conversation with a knowledgeable independent advisor to discuss issues pertaining to what type of a pension or retirement plan you and your employees should have. Should you consider placing some of your life insurance in your pension plan since it can be tax deductible?

Planning can become more challenging when different needs require different amounts of insurance for different time periods.

For example, the need for income replacement is based upon ones earnings and is only needed during ones working years.

Meanwhile, the need to indemnify a business loan or a business overhead expense typically calls for a fixed dollar amount regardless of your total income and is generally needed for a specific time period even if you stop working before the loan matures.

Sometimes a combination of both temporary and permanent products should be utilized. Keep in mind that because permanent products can be designed to provide a life-time guarantee they are more flexible for all types of business needs. For example, the tax deferred internal build up of a cash value contract can provide a Lump sum to supplement ones retirement as well as provide for a tax free death benefit available to buy out a partner, shareholder or just be available to provide a capital sum of tax free monies to one’s family.

Draw out a chart of how much insurance you’ll need for what length of time and then by looking at the big picture you’ll be able to take advantage of the scale of economies available when purchasing the right type of a contract from the most competitively priced provider, for the proper length of time thereby avoiding any unnecessary overcharges as a result of premature lapses of coverage.

Owner and beneficiary designations may differ on policies that address different needs. Be sure to clarify who are the participants and what are their roles. Be certain to consult with your legal and tax advisors to understand the ramifications of each ownership designation.

Keeping a written chart is an indispensable tool, as the scenarios can become complex. For example, a policy used for the purpose of family protection can list you as the insured and the owner your spouse as the primary beneficiary; and a trust as the contingent beneficiary. Meanwhile, a policy used for the purpose of key person insurance can list you as the insured, while your business could be the owner and beneficiary.

There are relatively few times that our tax laws allow a business owner to provide a personal benefit using a tax-deductible corporate dollar, on a discriminatory basis, but it can and should be done to the business owners benefit wherever possible.

Make certain that you shop the price of your current life insurance, with what’s currently available in the marketplace today. Often times, as a result of better pricing in recent years the cost of insurance has decreased and it’s now possible to obtain lower rates while maintaining the same coverage. Or you could perhaps continue to pay the same premium but have the dollar amount of your coverage increased. The most important aspect is to make certain that the guarantee period, the time that your contract will stay in force be maintained to at least to age 92. Many contracts I see today are set to expire while a person is in their 80’s and with life expectancy on the increase you want to make certain that your coverage doesn’t expire before you do.

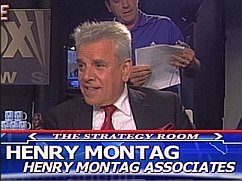

Henry Montag CFP, CLTC

Partner Financial Forums Inc

About the Author: Henry Montag is an Independent Certified Financial Planner as well as a CLTC. He’s been in practice since 1976. He is a contributing writer for The Moneypaper, a national financial publication, and sourced by Investors Business Daily, Long Island Business News, Newsday, Wall St Journal, The Moneypaper, Investment News, Senior Lifestyles and has held insurance and securities licenses for over thirty years.

333 Earle Ovington Blvd., Suite 402

Uniondale, NY 11553 516 394-2595

Website: www.financialforumsinc.com

Click here to download a complimentary copy of The Family Business Program

Leave a Reply