Medicare is an age based health plan provided to individuals that reach age 65. it is partially funded by the federal as well as state governments. Medicare will pay for 80% of health care costs up to various guidelines and then it stops paying anything. It was never intended to pay for all costs. In order to cover the 20% that Medicare will not pay, individuals must purchase a Medicare supplement plan. These plans will not only pay for the 20% not covered by Medicare but also will also pay for the various deductibles and co pays that are the patients’ responsibilities.

Understanding the different features and benefits of Medicare and Medicare supplement plans are very confusing. In my 36 years of practice I’ve continuously found that most individuals becoming eligible for Medicare at age 65 do not understand the new terms and provisions associated with their new healthcare provider, and as a result are not taking proper advantage of the various options and strategies available to them. Many are confused as to which of the I2 standardized plans are best for their specific situation and how to coordinate those plans with their overall health care objectives.

Many people mistakenly believe that since Medicare covers some long term care costs, that their Medicare supplement will continue to pay these costs if they need continuing long term care. However, after 100 days neither Medicare nor Medicare supplement plans will pay for any long-term care costs. Long-term care costs beyond the first 100 days are paid out of your savings or from a payment received from a Long Term Care Ins policy.

In addition, there are various penalties assessed against a person if they do not sign up for the various benefits in a timely manner. During a person’s open enrollment eligibility period they can not be turned down for coverage due to any health concerns. However if they wait beyond their open enrollment date they may not be afforded coverage until after a significant waiting period.

Since Part D prescription plans are relatively new very few individuals understand or are aware of how to best structure their Part D plan so as to personalize it to their specific needs. Not doing so will increase the amount of their out of pocket costs, otherwise known as the Donut.

Lastly, since all Medicare supplement plans are standardized in terms of identical features and benefits, and the only difference between them being cost, one must shop the market to make certain that they’re not paying more than they should. My experience tells me that since standardization went into effect over 10 years ago, one out of every four people are still paying more than they should and costs can range by as much as 20% between companies. Considering the average cost for a Medicare supplement is approximately $2000 annually, a couple’s savings can amount to more than $400 annually and that’s for each spouse.

The current trend in controlling runaway health care costs has been to increase one’s deductible to a higher dollar amount, so that if they have a claim at some point in the future they’ll pay a higher percentage then, but in exchange for assuming a higher risk, they’ll pay a significantly lower premium today.

A perfect example lies within the 12 Medicare Standardized plans currently available today. If you’re healthy and hardly ever go to a doctor needing beyond 1-2 prescriptions a year it may make sense to consider a high deductible plan (Plan F+) Doing so will allow each person to save approximately $400-500 annually from what he/she would have spent on a traditional medicare supplement plan. That’s a significant savings and an example of what can be achieved by seeking the guidance and advice of an experienced and independent source in this highly specialized area of Insurance. The consequence of not doing so may cost a couple upwards of $800-900annually.

==========================================================

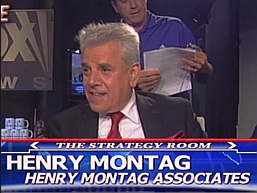

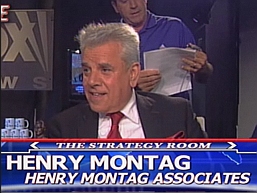

About the Author: Henry Montag is an Independent Certified Financial Planner as well as a CLTC. He’s been in practice since 1976 with offices on Long Island, New York. He is a contributing writer for The Moneypaper, a national financial publication, and has been a source for Investors business Daily, Long Island Business News, Newsday, Wall St Journal, The Moneypaper, Investment News, and Senior Lifestyles.

———————————————————————————-

Henry Montag CLTC

Phone: {516} 695-4662

Fax: {631} 549-2786

6800 Jericho Tpke. Suite 202W

Syosset, NY 11791

www.financialforumsinc.com

henry@financialforumsinc.com

To learn more about Henry Montag: http://www.youtube.com/watch?v=yTpACuc33fg

Leave a Reply