However, many times these “when’s” are merely replaced by other obstacles. The simple fact is that people don’t like, or want, to plan for the future. Often times things that need to be done today take priority and distracts a person from concentrating on what needs to be done in the future despite the consequences of not doing so. The result of such short-sighted thinking which has correctly been termed “planning deficit disorder” often leaves a person far short of what they could have had for themselves and their family.

“Time is Money”. We’ve all heard that before but it’s nowhere as important as when a person is saving for the future. It was Einstein who said that “compound interest” is the eighth wonder of the world. There’s simply no substitute for the fact that the 10 year difference between a person having 20 years to reach their retirement goal as opposed to 30 years is an extremely important unit of time that simply cannot be made up.

A 25 -30 year-old should should be encouraged to begin saving early whether in a 401k or in their own Roth, or IRA, especially if they’re fortunate enough to work for a company that has some sort of a matching program as that match is an outright gift from their employer and should be fully taken advantage of by the participant employee. Remember the longer the time frame you have before you’ll need your money the more risk you can afford to take with it. Conversely if you’ll need the money relatively soon make sure enough of it is liquid.

Every working person should take maximum advantage of their 401k and/or profit sharing plan or even open up a private IRA or Roth plan to allow their money to grow and accumulate on a tax deferred basis. There should be no such excuse as “I don’t have enough money to save”. A person should always be able to pay themselves first and put away at least 10% of the money they earn today for the future. Not doing so can be one of the worst financial mistakes made during that all important Accumulation Phase of a person’s life.

Living within your means and creating a saving fund for the future should be a part of that budget. Set a specific number. If you earn $100,000 make certain that you put away $10,000 a year or $800 a month or $200 a week. If your number is a million, just add a zero. The point is, be specific and take advantage of the power of setting and thinking about a specific goal. If it means taking one less vacation a year or going out for one less meal a week so be it, as the end results will have a far reaching effect on their financial future AND well being. Just imagine if today you had saved 10% of all that you had earned over the last 20-30 years of your working years. I always tell people 10% of all you earn is yours to keep.

People say “Well, I keep it all what do you mean about 10%”? That’s when I remind then that they first have to pay the taxes and many day to day living expenses and if they’re not careful there may not be anything left to save. There are two types of people: those that “spend first” and save what’s left over, and those that “save first “and spend what’s left over. if you spend first there may not be anything left over to save.

Remind your kids and/or grand kids that its so important to their mental and financial well being that they always strive to maintain their financial independence and the best way to do that is by becoming a “saves first” person that’s created enough available assets to maintain their lifestyle through any difficult period.

Always diversify your investments and your advisors as well. Don’t chase after past performance as you may have learned it’s not always an indicator of what may happen in the future. Often times when a successful money manager leaves their current firm as a result of a better offer from a competitor, an investor wonders why a funds performance didn’t do quite as well as they had in the past. Keeping current with that type of information is an example of what may differentiate an experienced investment professional from their peers.

Thirty years ago when the norm was for an investment firm to expect and enjoy an exclusive financial relationship with their client one would differentiate themselves by suggesting that no one person has a monopoly on all the good ideas. Well, that concept has progressed to the point where, according to research from Cerulli Associates, a moderately wealthy individual has on average five financial client/advisor relationships at the same time. This of course is done to not only minimize their risk exposure to any one relationship but also to make sure they’re not missing any opportunities. By the way when working with any new professional relationship it’s always important to check their complaint history in the state they’re licensed in.

During the Conservation Phase make certain you’re comfortable with your current level of risk tolerance and be aware of your income needs now and in the future. Keep inflation in mind and make certain you don’t eat into your retirement income if you have to pay for an unreimbursed long term expense. Many individuals are taking advantage of the various types of “income annuities” that guarantee a lifetime income. These income annuities have become a very popular planning technique especially in today’s turbulent economic times because many individuals want to make certain that their retirement assets are guaranteed, adjusted to keep up with inflation and can not be outlived by one or both spouses.

Since your earning power is one of your greatest assets make certain that you protect it with a portable disability contract you can take with you if you leave your current place of employment and go elsewhere. It’s important to work with an experienced independent insurance advisor that will be able to suggest what’s best for you in your particular situation. Women do live longer than men and their spouse or significant other may not be around to help them in the event that they need help with their daily living activities when they reach their 80’s (70% of nursing home population is female). We know that’s only the tip of the iceberg as many more people are at home and in assisted living facilities but statistics are not kept for care at home.

I suggest to my clients that once they reach age 55-60 they purchase a traditional stand alone long term nursing care contract, while they’re still inexpensive and available. It’s an extremely important risk management vehicle to make sure that one’s future financial well being and independence are maintained even if they require an extended unreimbursed long term care expense at some point in their life. Doing so will allow friends or family to care about their loved one rather than caring for them. In my opinion the biggest threat to a comfortable retirement today is not inflation, deflation, a change in interest rates or taxes, and not even a stock market crash. It’s an unexpected unreimbursed long term care expense, where the money once earmarked for retirement will now have to be used to pay for the cost of care.

As a result of the Pension Protection Act which became effective in January 2010 the insurance industry has created some new and very favorable “combo products” which combine the benefits of a long term care contract and a life insurance product. It not only maximizes ones assets but also allows their beneficiaries to receive a death benefit if they never need long term care.

There are are several other new tax strategies that you and your advisor should become familiar with as they will benefit you, your family, and business. Make certain you ask your tax advisor or insurance broker to explain them to you, if they haven’t mentioned the opportunities available to you.

Since the emphasis has always centered around the husband as primary breadwinner few women took time to learn how to plan for themselves. Many times a woman may find herself single as a result of a divorce or the premature death of a loved one and she’s not familiar with the most basic financial aspects of running her or her family’s finances. Make certain that you prevent a child or a grandchild from ever being placed in that situation. It’s important for everyone even if you’re married and your spouse does it for you, to manage you own finances as well as your own credit. Speaking of credit, with today’s low interest rate environment one should make certain that they’re not sitting with an 18% or higher credit card or revolving loan balance while they’re earning 1-2 % on their current CD or money market.

If you have financial obligations and are the primary breadwinner for your family its important that you review and update your current life insurance portfolio as costs of insurance have decreased over the last 10-15 years. It may be possible to increase your coverage, decrease your costs or depending on your health, accomplish both. One of the most significant things is that you make certain that your life insurance contract doesn’t expire prematurely. Remember universal contracts are not guaranteed and may expire earlier than you may have thought would be the case.

One of the most significant aspects of taking the time to plan is to review and audit what you already have and compare it to where you or your child or grandchild wants to be. This can be done with assets that you already own as well as with goals they’ll want to achieve. Often times existing financial products can be significantly enhanced when compared to what may currently be available.

If you are a business owner you have an opportunity to transfer corporate/ business assets into personal benefits for yourself as well as for your family and as a result you can take advantage of many of the laws on the books today that allow an individual to discriminate in favor of a highly compensated individual for all sorts of benefits i.e., retirement, to supplement retirement assets with a private pension plan or to use corporate assets to pay for long term care and other forms of insurance on a discretionary basis.

A conversation with an experienced independent advisor who can discuss various trust matters with your attorney may put you in a better position to not only take advantage of the new tax and estate tax laws, but may also assist you in maximizing those assets for a charity, an alma mater as well as for those earmarked for the next generation.

————————————————————————————

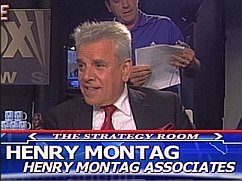

About the Author: Henry Montag is an Independent Certified Financial Planner as well as a CLTC. He’s been in practice since 1976. He is a contributing writer for The Moneypaper, a national financial publication, and sourced by Investors Business Daily, Long Island Business News, Newsday, Wall St Journal, The Moneypaper, Investment News, Senior Lifestyles and has held insurance and securities licenses for over thirty years.

333 Earle Ovington Blvd., Suite 402

Uniondale, NY 11553 516 394-2595

Website: www.financialforumsinc.com

Download a complimentary copy of The Family Business Program

Leave a Reply