When it comes to Retirement planning conventional wisdom has it that you direct your IRA or 401 contributions into a deductible IRA or 401,403 account, so that when you retire you’ll presumably be in a lower tax bracket than you’re in today. But what if conventional wisdom is wrong? In the mid 1980’s top tax brackets were as high as 69%. It was logical to think that people would be in a lower tax bracket when they retire as most people earn less at retirement than when they’re employed. However, today top tax rates are only 39.6% and when one considers our tremendous deficit and political pressure it’s more likely than not that tax rates will once again rise in the future.

When it comes to Retirement planning conventional wisdom has it that you direct your IRA or 401 contributions into a deductible IRA or 401,403 account, so that when you retire you’ll presumably be in a lower tax bracket than you’re in today. But what if conventional wisdom is wrong? In the mid 1980’s top tax brackets were as high as 69%. It was logical to think that people would be in a lower tax bracket when they retire as most people earn less at retirement than when they’re employed. However, today top tax rates are only 39.6% and when one considers our tremendous deficit and political pressure it’s more likely than not that tax rates will once again rise in the future.

Moreover, there’s a distinct possibility that scenario may happen. All of those dollars you’ve accumulated and have hopefully grown as a result of your hopefully smart investment decisions will be taxed in a higher tax bracket. So instead of paying a small tax on the “seed” — your yearly contribution, conventional wisdom has you not only paying taxes on the entire harvest but doing so while you’re in a higher tax bracket. That being the case, conventional wisdom has just harmed, not helped you to be better prepared to maximize your retirement assets.

A better nonconventional alternative would be to consider directing any new contributions to your IRA, 401 or 403 into a non-deductible Roth IRA or 401, 403 account. Everything except for the titling of the account stays the same. You have the same choices and receive the same statement from the same company. In both plans any of the gains in the account grow tax deferred. The only difference is that you don’t take a current tax deduction on any contributions you make and you don’t have to pay any taxes on the money you eventually withdraw. Regardless of whether taxes go up or not, being able to receive your income 100% tax-free is by far a much-desired choice.

Another situation faced by many occurs when individuals in their 50’s finally realize they didn’t take advantage of starting to save for their retirement 15 or 20 years ago. They do nothing figuring it is too late. Or, there are those who not only take advantage of the catch up provisions which now allow an individual over age 50 to deposit up to $6,500 annually into their traditional IRA accounts, but they feel compelled to take unnecessary risk to try to make up for the fact that they hadn’t taken advantage of what Einstein called the eighth wonder of the world — “compounding Interest”. Conventional wisdom tells us that there have only been only 2 times in the last 69, 10-year periods that the stock market hasn’t risen, so Investing in the stock market is the place to be.

But since the last time it happened was as recent as 2002-2012, that thought has encouraged many people to feel that they need to take on even more risk to make up for those lost years, especially now that bonds are providing such low yields. Is there a better way to catch up? There is but only for those with a good trusting relationship with one or both of their parents who are healthy enough to purchase a life Insurance policy on their lives, and who can see past the emotional hurdle of a son or daughter benefiting from the death of a parent.

So Instead of placing that $6,500 contribution into a traditional IRA, 401 or 403 account where the amount that they’ll eventually receive could be more or less than what they’ve deposited, and will be fully taxable WHEN DISTRIBUTED, they could consider using all or part of that $6,500 annual deposit to purchase a life insurance contract on one or both of their healthy parent’s lives. The outcome will be a guaranteed death benefit significantly greater than what the individual deposited into their account. In addition, the death benefit of a life Insurance contract is 100% income tax free. The proceeds would be received by the retiree net of any taxes. A very good alternative strategy that can be used to catch up without taking any risk, let alone more risk.

About bonds: Conventional wisdom has always told us that bonds are relatively safe Investments with less risk than a stock. But with today’s low interest rate environment I feel that the risk of rising interest rates make bonds far riskier than stocks.

Conventional wisdom also tells us you can’t do anything about death and taxes. Not true. You can do a lot about your taxes. For example, an individual now receiving both social security and an IRA distribution can very simply convert a part of their IRA into a Roth because a distribution from a Roth IRA does not count towards the modified adjusted gross income, MAGI. That will bring down their income to an amount below the threshold for taxing ones social security benefits. The same holds true for determining the amount of Medicare premium a person will contribute as it’s based on a person’s adjusted gross income, AGI. While people can’t evade their taxes they can certainly take steps to avoid them and arrange their assets so as to maximize their wealth and minimize their tax obligations.

A majority of individuals ascribe to many poor choices that are just plain wrong, and they must strive to overcome their PDD, Planning Deficit Disorder. People spend significantly more time planning their vacation than planning their own retirement. For example, conventional wisdom would entail purchasing a life insurance contract and then place it in a drawer never to be looked at again until a beneficiary sees it. If its a universal or term contract (and its not occasionally reviewed) you (may not) know if its a problem till its too late. Planning ahead is more than a phase, it’s a way to challenge conventional thinking to make sure you come out on top.

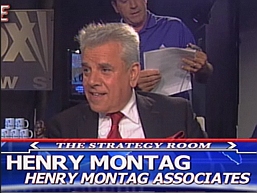

Watch Henry Montag’s video advice on intergenerational wealth building

Henry Montag CFP, CLTC

Financial Forums Inc.

516 640-1315

www.financialforumsinc.com

henry@financialforumsinc.com

to learn more about Henry Montag: http://www.youtube.com/watch?v=yTpACuc33fg

Leave a Reply