If you purchased your Life Insurance anytime from the mid 80’s through 2005 there’s an 85% chance that the type of life Insurance you purchased was a Flexible Premium life Insurance contract that unlike their more expensive predecessor Whole Life Insurance was not guaranteed to last for the rest of your life.

How did that happen?

In the mid 80’s when Interest rates were very high 17-18% many people began withdrawing their cash value accumulations in their life insurance contracts that were only earning 3-4% and began transferring them into banks and CD’s. In order to stop this tremendous outflow of money from the cash value accounts of life insurance policies to the banks, the insurance industry came out with a new product called Universal life Insurance. This type of a life Insurance contract paid a higher competitive interest rate but the rate was not fixed and the performance of the life Insurance contract was tied into the performance of the prevailing interest rate at the time. While everyone was concentrating on the interest rates no one spoke about the fact that the contract was not guaranteed and that the insured assumed 100% of the performance risk of the life Insurance policy.

How did interest rates affect the performance of the contract?

Since interest rates were substantially higher when these contracts were first taken out in the late 1980’s and early 1990’s people assumed their contracts would earn significantly higher interest rates. However when the interest rates began declining neither the insured nor the owners of the life Insurance policies altered their assumptions downward nor did they pay a higher premium to the life Insurance company as they should have to make up for the reduced earnings.

So after years of reduced interest rates and the years of neglect on the part of the owners or insured’s that didn’t know that they had to manage their contracts and pay a higher premium to make up for the shortfall in earnings, approximately 35% of individuals life insurance contracts are expiring while the insured are still in their mid to late 80’s and need the coverage to continue uninterrupted. Click here for more information.

Isn’t the insurance company or the agent monitoring this?

The agent is contracted with and obligated to the insurance company and not to the insured. It’s the agent’s job to merely distribute the insurance policy to its customers. It’s the insurance company’s job to send the owner an annual statement. And most importantly it’s the insured’s job to manage the life insurance contract and make certain there’s enough premium being paid to keep the insurance in force until well past a person’s life expectancy. Reason is because the insured has assumed 100% of the performance risk and the contract is otherwise not guaranteed.

Is the insurance company going to let this happen if I paid my premium on time?

Actually as long as the Insurance Company does what it is legally required to do which is to distribute the annual statements to the Insured’s at their annual anniversary their obligation is complete. The insurance company is actually quite happy to see a person that has been paying their premium for all those years have their life Insurance policy expire early as the insurance company will not have to pay a death benefit. The responsibility was transferred to the insured. But the insured never realized the responsibility was theirs until just now when organizations like www.thetolicentereast.com or the Insurance Trust Monitor are making people aware of their circumstances.

What can I do to learn more?

You can click on the attached links to read more about this situation

Link to Investment News Nov 2013 Long Island Business News Dec 2013

What can I do to prevent my contract from expiring prematurely?

It’s important that you obtain an independent performance evaluation regarding your particular life insurance policy to determine whether you’re affected and if so how much longer you’re current contract will last based on the current premium you’re paying. The sooner you find out what your situation the more options you’ll have available to you.

What type of options will I have available

• You may have to pay a higher premium to keep the same death benefit you thought you had in force to your mid 90’s.

• You may be able to reduce the death benefit to keep the reduced coverage in force until your mid 90’s.

• You may, depending on your health, be able to purchase a new life insurance contract with guarantees that last until your mid 90’s for a similar cost even though you’re older as a result of reduced costs for new contracts.

• You may be able to sell your life Insurance contract which is known as a life settlement where you may receive more money than if you just returned the insurance company back to the insurance company.

Is there a cost for this service?

Just as you would expect to pay a professional who manages your stock or Bond Investment portfolio a fee for their service there will be a charge to have an independent entity provide you with a performance evaluation service as well.

For more information contact:

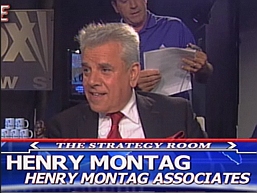

Henry Montag, CFP, CLTC

The TOLI Center East

(516) 695-4662

Leave a Reply